Own A Sch C And Can I Withdraw Money From Business And Issue 1099

If you're a business owner, the IRS wants to know everything you've both earned and spent each year on your business. If you have driven for work, they will also want to know the mileage amount. For some business owners, reporting this means using Schedule C. Not sure if you need to fill one out? Keep reading for general guidelines that will help you decide.

It can seem like a lot of work, but if you follow the step-by-step instructions below, this will help you fill out your Schedule C successfully!

What this article includes:

- What is a Schedule C Tax Form and how do I know if I need one?

- How Everlance can help with your Schedule C (and how to get your data)

- What you'll need to fill out a Schedule C:

- How to fill out the Identity Section

- Part 1: Income

- Part 2: Expenses

- Part III: Cost of Goods Sold

- Part IV: Information on Your Vehicle

- Part V: Other Expenses

What is a Schedule C Tax Form and how do I know if I need it?

This form is used to report income and expenses and ultimately helps to undermine whether a business has a profit or loss for the year.

If you are the sole proprietor of your business, then Schedule C will be used to report any income or loss from your business. Additional qualifications for Schedule C (in addition to being the sole proprietor) include:

- You are engaging in the activity with the intent to make a profit

- You continue with the profit-making activity on a regular basis

If you run a business that meets the above requirements and you receive self-employment income, you need to complete a Schedule C in addition to your Form 1040.

How Everlance can help with your Schedule C (and how to get your mileage report).

If you have Everlance set up to track your expenses as well as your mileage, you'll need this to report on your taxes (e.g., Line 9 of Schedule C asks for a total of your business vehicle expenses).

Let's get started! Use the app 'export data' feature or visit the web dashboard https://dashboard.everlance.com/ and follow these steps:

Step 1a) Click on "Data Export" in the left hand column

Step 1b) Select +New Export

Step 2: The filter options will appear. In the Basic Filter options, select the date range you would like the report for. Please note the quick select options below the calendar (ex. "last year").

Step 3 (Premium only) : Select from the Advanced Report options

- Format: Choose Excel, CSV, or PDF reports (users on the free plan receive CSV reports only).

- Purpose: The report type or purpose (e.g., Work, Personal, etc).

- Export Type: Choose between Trips, Expense or All.

Step 4: Select Generate Export and the report will be a) sent to your inbox and b) immediately available for download to your computer.

When you open your report, you'll find the total mileage amounts in the Summary (one image shows what it will look like in PDF and the other in a CSV report).

An example of where you'll use this data is in the respective fields of Line 44:

Follow the same steps as above but choose a "Transactions" (or Expense/Revenue) report if you need to get your business expenses for your Schedule C.

Keep reading for further breakdowns/explanations of the different lines that can be complicated to understand.

Filling Out Your Schedule C

We'll walk you through each section of Schedule C to help you identify what information you need to enter. Want additional resources about deductible expenses? Check out Everlance's free Tax Academy resource.

Or, if you want to take tax prep off your to-do list, consider getting help from the tax team at Block Advisors. Everlance has partnered with Block Advisors, a team at H&R Block specially trained in self-employed and small business taxes, for a special combined offer. They can take care of your tax filing, so you can get back to business!

Before you begin the form, make sure you have the following information available.

- Home office and vehicle expenses

- 2020 Mileage Log

- Your Profit and Loss Statement

- List of assets purchased this year

Lines A-I

Line A: Enter your name and a brief description of your business, such as "photography" or "landscaping."

Line B: Enter in the relevant code from the Principal Business or Professional Activity Codes found here.

Line D: Enter in your Employee Identification number (NOT your SSN!). If you don't have an EIN, leave it blank.

Line F: Checkoff the accounting method, cash or accrual, you have used when calculating your income and expenses. Not sure which one to choose? Read below for a quick explanation of each:

- Cash Accounting Method: Income is generally recorded when you actually receive it, and expenses are generally recorded when you actually pay them. Most businesses without inventories use the cash method.

- Accrual Accounting Method: Income is reported in the tax year that it was earned, although payment may not be collected until the following year. This method is usually practiced by larger businesses that carry inventory.

Line G: Did you participate in your business in 2020? If so, check "yes."

Line I: Did you hire a subcontractor to help with your business in any capacity? If yes, and you paid them more than $600 in 2020, you'll also need to send Form 1099-NEC to those whom you pay $600 or more (before 2020, you would have reported those payments on Form 1099-MISC).

Okay, great job so far! We've made it through the identity section. Now let's go to the next part where we breakdown your income.

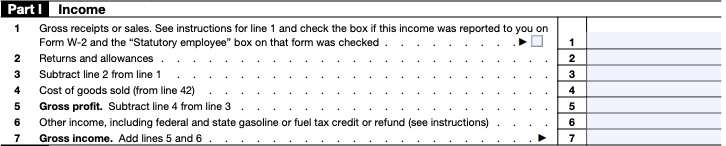

Part 1: Income

Here's where you'll list the money that you earned from your business in 2021.

Line 1: Your gross sales/receipts goes on Line 1. Give the dollar amount for all products/services you sold.

Line 2: Returns and Allowances include cash or credit refunds you make to customers or price reductions on products/services.

Line 3: Subtract the total of your returns and allowances from your total sales for the year.

Line 4: Cost of goods sold. Cost of goods sold also includes all of your costs for making products, storing them, and shipping them to customers. To calculate the cost of goods sold you must value your inventory at the beginning and end of the year (jump to Line 42 to make this calculation).

Line 5: Gross profit--subtract the cost of goods sold and returns and allowances will be subtracted from the gross receipts/ sales. Once you've calculated this, it will give you your actual profit.

Line 6: If you earned any other income, such as an award or federal tax credits, list it here.

Part 2: Expenses

In lines 8-27, you will list all of your business expenses (advertising, vehicle expenses, insurance, etc). A lot of the line items are self-explanatory, but we'll breakdown a few that can be tricky.

Line 9: Car and Truck Expenses. You'll be able to claim expenses using two different methods: by using a standard mileage rate deduction (56 cents per mile in 2021) or by using the actual expenses incurred (e.g., gas, vehicle maintenance, etc.).

Whichever method you choose, it's vital to keep accurate records and receipts in the event you are ever audited. If you use Everlance, you can request a report of your business expenses for the amount of vehicle-related expenses:

You would then enter in the correct amount in Line 9:

Remember that if you used your vehicle for your business, you'll also need to enter a few questions about your vehicle in Part IV.

Line 10: Commissions and Fees. Line 10 is a sort of catch-all category for any money you paid to other businesses for services. An example might be fees you paid to a consultant.

Line 11: Contract Labor. Payments to contractors or freelancers go here.

Line 12: Depletion. N/A unless you're in a mining, timber, or quarrying industry.

Line 13: Depreciation and section 179 expense deduction. Usually, you can't write off the entire cost of a property purchase (buildings, equipment, etc) in one year. What you can claim is the depreciation deduction for that year. Enter the amount of your eligible depreciation deductions for 2021 on this line.

Line 24 A and B: Travel and Deductible Meals. This is where you'll include costs for travel and meals. The IRS does have restrictions on the expenses you can take.

Line 30: Expenses for business use of your home. Many self-employed people work from home. That means part of your household utility bills can be claimed as a business expense. Visit the IRS website to learn how to calculate your deduction.

Part III: Cost of Goods sold

If you sell products or subcontract, you'll need to fill in Part 3 (most service-based businesses don't have to fill out this section). Most of this section is pretty straightforward, with clearly-labelled requests, such as the cost of materials or supplies. You can find most of this information on your income statement. However, we've provided a few explanations for some of the less-obvious sections.

Line 33: Method(s) used to value closing inventory. Checkoff the method, Cost or Lower of Cost or Market, you used to value your inventory at the end of the year. Not sure which one to choose? Read here for a quick explanation of each:

- Cost: Literally, the cost of purchase. If you're using cash accounting, this is the only way to value your inventory.

- Lower of Cost or Market: Comparing the price you paid with the market value for the item, on a specific valuation date each year

Line 34: Was there any change in determining quantities, costs, or valuations between opening and closing inventory? Have you changed how you account for your inventory? If not, select "no." If yes, provide an explanation that gives the change.

Line 36: Purchases less cost of items withdrawn for personal use. Give the total of all you made during 2021. However, if you remove any purchases for personal use, make sure this is excluded from the total.

Line 42: Make sure that the same number is listed in Line 4 of Schedule C.

Part IV: Information on Your Vehicle

If you're claiming an expense for your car or truck, you'll need to fill out this section.

Line 43: When did you place your vehicle in service for business purposes? This is the date you started using your vehicle for business purposes.

Line 44: Of the total number of miles you drove your vehicle during 2021, enter the number of miles you used your vehicle for Business/Commuting/Other. When listing the mileage, please don't guess. Only list the mileage you actually have safely documented such as what you have recorded in your Everlance app. You will then enter in these totals in the respective fields of Line 44:

Remember, if you have more than one Work purpose, only enter the amount for the income source this Schedule C is reporting for.

Part 5: Other Expenses

If any of your costs don't fit into the pre-filled categories listed in Schedule C, you can list them here in Part V. Remember to go back to Line 27a and enter the total of all lines, including anything in Part 5.

NOTE: Your tax situation is unique—just like you! This blog represents generalized tax information. Everlance Support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about Everlance. If you need income tax advice please contact a tax professional in your area.

Own A Sch C And Can I Withdraw Money From Business And Issue 1099

Source: https://www.everlance.com/blog/how-to-complete-your-schedule-c-tax-form

Posted by: townsdecommand.blogspot.com

0 Response to "Own A Sch C And Can I Withdraw Money From Business And Issue 1099"

Post a Comment